Medicare Graham Things To Know Before You Buy

Medicare Graham Things To Know Before You Buy

Blog Article

Medicare Graham Fundamentals Explained

Table of ContentsWhat Does Medicare Graham Do?The Ultimate Guide To Medicare GrahamThe 5-Minute Rule for Medicare GrahamMedicare Graham for BeginnersTop Guidelines Of Medicare Graham

Prior to we talk about what to ask, allow's talk concerning that to ask. For numerous, their Medicare journey begins directly with , the main web site run by The Centers for Medicare and Medicaid Providers.

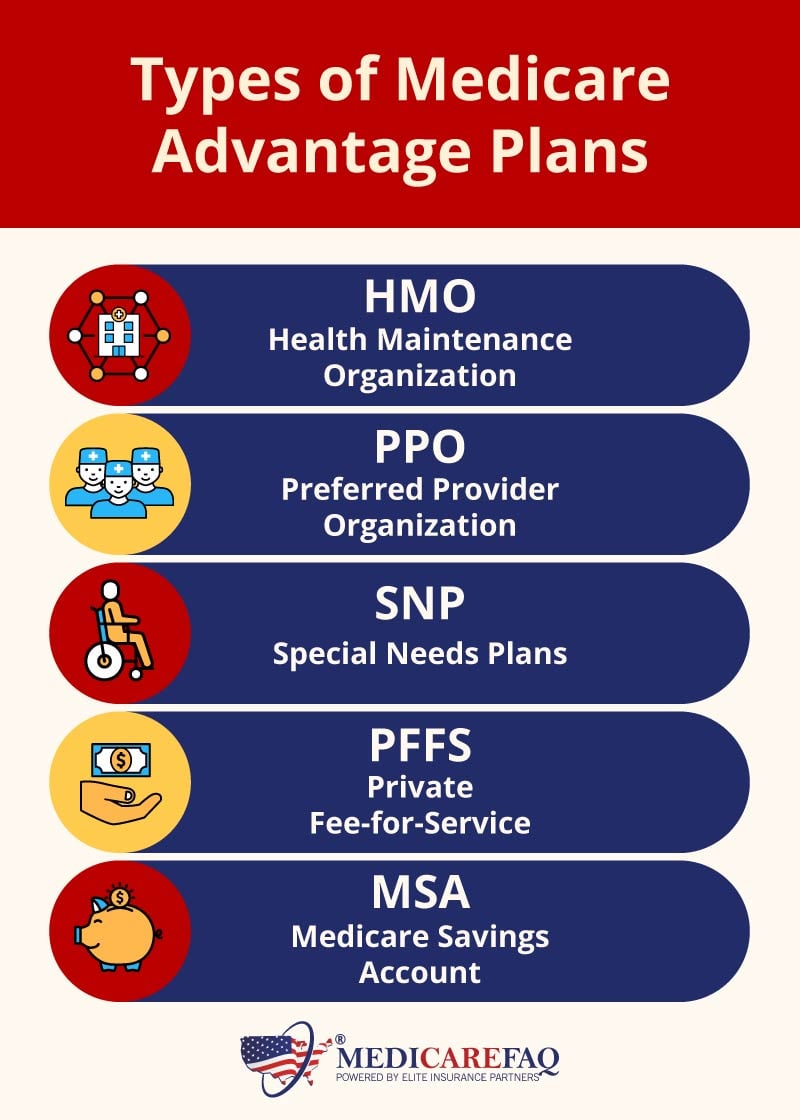

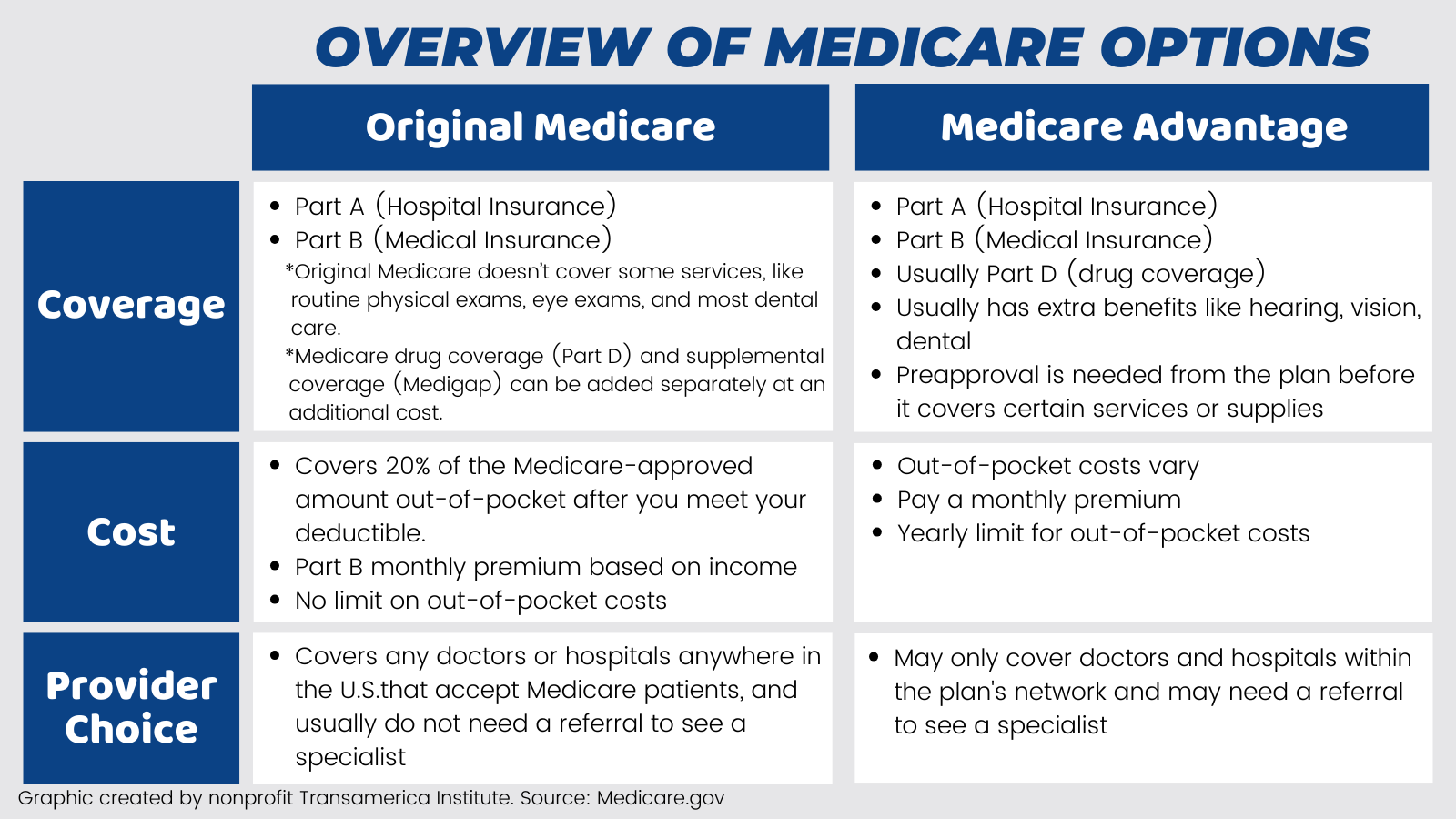

It covers Part A (medical facility insurance policy) and Part B (clinical insurance coverage). These plans function as a different to Initial Medicare while providing more advantages.

Medicare Component D prepares help cover the expense of the prescription medications you take at home, like your day-to-day medicines. You can enlist in a different Component D plan to include drug coverage to Original Medicare, a Medicare Price strategy or a few various other types of plans. For many, this is commonly the initial inquiry thought about when looking for a Medicare strategy.

Not known Facts About Medicare Graham

To obtain the most cost-efficient health treatment, you'll desire all the services you make use of to be covered by your Medicare plan. Your strategy pays whatever.

, as well as insurance coverage while you're taking a trip locally. If you plan on traveling, make sure to ask your Medicare consultant concerning what is and isn't covered. Perhaps you have actually been with your existing physician for a while, and you want to maintain seeing them.

Not known Facts About Medicare Graham

Many individuals who make the switch to Medicare continue seeing their normal medical professional, however, for some, it's not that basic. If you're functioning with a Medicare consultant, you can ask if your physician will be in connect with your new strategy. If you're looking at strategies separately, you might have to click some web links and make some telephone calls.

For Medicare Benefit plans and Expense plans, you can call the insurance provider to see to it the medical professionals you wish to see are covered by the plan you're interested in. You can likewise examine the strategy's site to see if they have an online search device to find a protected medical professional or clinic.

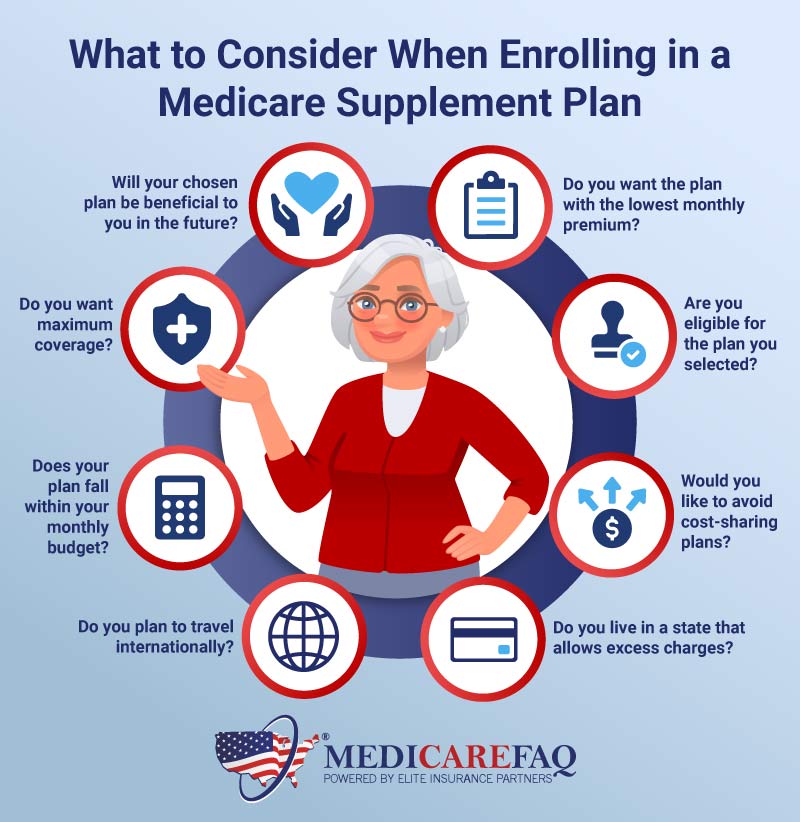

So, which Medicare plan should you select? That's the best component you have options. And ultimately, the option is up to you. Bear in mind, when beginning, it's essential to make certain you're as notified as possible. Begin with a listing of factors to consider, see to it you're asking the appropriate concerns and start focusing on what kind of plan will certainly best offer you and your requirements.

Some Known Details About Medicare Graham

Are you about to transform 65 and end up being recently qualified for Medicare? Selecting a plan is a large decisionand it's not always a simple one. There are necessary things you need to understand in advance. The least pricey plan is not always the ideal alternative, and neither is the most pricey strategy.

Also if you are 65 and still functioning, it's a great concept to review your options. People getting Social Safety and security advantages when turning 65 will certainly be automatically registered in Medicare Parts A and B. Based upon your work circumstance and healthcare choices, you might require to discover here take into consideration signing up in Medicare.

Consider the different kinds of Medicare intends available. Initial Medicare has two components: Part A covers a hospital stay and Part B covers medical expenses. However, lots of people locate that Components A and B with each other still leave spaces in what is covered, so they purchase a Medicare supplement (or Medigap) plan.

The Main Principles Of Medicare Graham

There is generally a costs for Part C policies on top of the Component B premium, although some Medicare Benefit plans offer zero-premium plans. Medicare Lake Worth Beach. Evaluation the protection information, prices, and any kind of fringe benefits offered by each plan you're considering. If you enlist in original Medicare (Components A and B), your premiums and protection will be the very same as other individuals that have Medicare

(https://www.kickstarter.com/profile/m3dc4regrham/about)This is a fixed amount you may need to pay as your share of the price for care. A copayment is a fixed amount, like $30. This is the most a Medicare Benefit participant will need to pay out-of-pocket for covered services each year. The quantity differs by plan, yet when you get to that limitation, you'll pay absolutely nothing for protected Component A and Component B services for the remainder of the year.

Report this page